Rock, Solid and Reslient - Ashok Leyland Ltd Stock Analysis

Dheeraj G Hinduja, the Chairman of Ashok Leyland Ltd in his message on Annual report of the company 2020-21 quoted that the "company combined its electric vehicle assets into a single entity under the name Switch mobility". It is clear that that the company foresee the exploration of EV in growing economy like Indian market. Ashok Leyland Ltd, a flagship company of hinduja group has a strong brand and well diversified distribution of domestic medium and heavy commercial vehicles segment.

Key Factors.

- Ashok Leyland's truck segment ranges from 2.5T GVW to 55T GTW.

- Ashok Leyland ranks 14th in the manufacturing of trucks globally.

- It launched India’s first-ever BS-VI compliant with i-Gen6 technology AVTR truck under the modular platform for the medium & heavy range in FY20.

- Ashok Leyland ranks 3rd globally in the manufacturing of buses. Its products are Mitr, SUNSHINE, OYSTER etc.

- They have launced India's first electric bus and Euro 6 compliant truck in 2016.

- Ashok Leyland has 7 manufacturing plants in India, 1 in UAE and 1 in UK.

Analysis of Financial Statement 2020-21

The latest Financial statement available is for the year 2020-21. During the FY 2020-21 , company reported a PAT of Rs. -69.60 crores. The major expenses incurred during that year is Rs. 2159 crores for employee benefit and Rs. 1900 Cr for financial costs. From the data , company compensated their profit for clearing debt and finance costs. Free cash flow of the company is Rs.227.45 crores which is positive indication in Cash flow statement. Current assets of the company is less than non-current assets. It is always better keeping the current assets higher than non-current so as it indicates the liquidity is higher. Even thought the Financial statements of Annual report 2020-21 gives a negative indication on financials of the company, Ashok Leyland Ltd always have a potential to multiply the investors money. The statement quoted above can be confirmed from the analysis of stock price of company. In April 2020 the stock price of Ashok Leyland Ltd is Rs. 53 and after one year in April 2021 the price almost doubled and raised above Rs. 130.

|

| Weekly chart of Ashok Leyand |

Some Important values

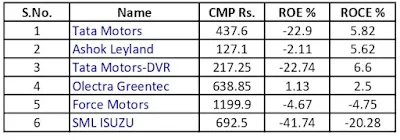

- ROE - (2.11%) and ROCE - 5.62% The ROE and ROCE values are low and a bit confusing about the performance of the company. But as we see the same values of other companies in same sector it will be convinced. As we compare the peers, we can see that the values are common to the sector.

|

| ROE and ROCE values of Automobile sector |

- Promoter holding 46.41% It is an average range shown in the sector analysis.

Latest news on company

- March 23 , 2022 - Ashok Leyland Ltd inaugurated a new 3S, Ahuja automobile in Korba, the power capital of chattisgarh.

- March 07, 2022 - Ashok Leyland Ltd Opens new 4 dealerships in Karnataka state.

- Feb 28, 2022 - Ashok Leyland launched India's first 9-speed AMT Tipper - AVTR 2825

Still as per the stock market analysts, the stock price of Ashok Leyland Ltd is expected to attain a price of Rs.190 within a period of one year. The important pros and cons of Ashok Leyland Ltd are included in this section. It only covers a small part of the analysis as including the entire study may reduce the relevance of main content. If you have any suggestion on the inclusion of any other details please refer it in the comment section.

Follow this page for new updates and study on Indian stock market. Follow link may be found on home page of this site under the widget "Followers". You can refer my previous content on stock market trends.

IF YOU ARE CONFIDENT WITH YOUR WRITING AND COMMUNICATION SKILL THEN CONVERT YOUR SKILL TO MONEY. CHECK THE SIDEBAR OF THIS BLOG FOR MORE INFORMATION.

TIPS

👇

MILLIONAIRE SECRETS

The best GUIDE on how to make money online

Whats in 6 FIGURE INCOME:

- Instagram Wealth Generator 3.0

- Dropshipping Masterguide

- Amazon FBA

Why you should promote 6 FIGURE INCOME?

- Earn 70% Commission

- High Conversion rates

- Universal Product

- Professional Marketing Materials

Thankyou for your consideration

ReplyDeleteUpcoming IPO

The content of this blog is explanatory enough to boost my knowledge

ReplyDeletehttps://www.indiratrade.com/tools/margin-calculator

This comment has been removed by the author.

ReplyDeleteNice Blog.

ReplyDeletedemat account opening

Nice Blog.

ReplyDeletedemat account opening

Best information and this is also help me

ReplyDeleteThankyou for your consideration

ReplyDeleteUpcoming IPO

Thanks for the usefull blog.

ReplyDeleterefer and earn demat account

Thanks for sharing this information with us.

ReplyDeletedemat account opening