Multibagger in Infrastructure sector- NCC Ltd - Annual Report 2021-22

Highlights

- Engaged in infrastructure sector.

- Built in resilience delivering growth.

- Chairman - Hemant M Nerurkar.

- Construction segments - Building & Housing, Water & environment, Roads, Electrical , Mining, Irrigation, Power, Railways and Metals.

- CFO - Sri. K Krishna Rao.

- Statutory auditors - M/s S R Batliboi & Associates LLP.

- Dividend of Rs.2/- announced per equity share on the face value of Rs.2/- on board meeting held on 11th May 2022.

NCC Ltd is established in 1978 as a partnership firm and converted into a limited company in 1990. The annual report 2021-22 of NCC Ltd gives a positive outlook for the investors. During the year under review NCC shown a resilient performance. There is an increase in the FY23 budget allocation for capital expenditure from 6.02 Lakh crore in FY22 to 7.5 Lakh crore.

During the FY 2021-22, NCC undertook a wide range of socio economic, healthcare and educational initiatives under its CSR programme touching the lives of the marginalized population.

The group reported a revenue from operations of Rs. 11137.96 crores during the year 2021-22 as against Rs. 7949.42 crores in the previous year, an increase of 40 percent.

During the financial year 2021-22, company reported a net profit of Rs. 482.41 crores against Rs. 268.31 crores in the previous year, growth of nearly 80 percent. Borrowings taken by the company decreased by Rs. 604.84 crores during the year under review.

Loans given to group companies and other corporates increased from Rs. 329. 99 crores to Rs. 407.81 crores. Mainly on account of loan given to NCC Vizag urban infrastructure limited.

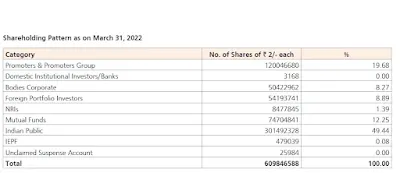

Promoter holding of the as on March 2022 is 19.68 percent of total outstanding shares. The geographical presence of company outside India is at Sultanate of Oman and Srilanka. Basic earnings per share is 7.86.

The financial report 2021-22 of NCC Ltd shows a resilient growth and consistency of the firm. The key points of annual report is included in this article. For reading the complete ANNUAL REPORT of NCC click the link.

To read my previous article click on this link. This article is prepared by referencing annual report of NCC Ltd and the data shows here are according to the annual report.

IF YOU ARE CONFIDENT WITH YOUR WRITING AND COMMUNICATION SKILL THEN CONVERT YOUR SKILL TO MONEY. CHECK THE SIDEBAR OF THIS BLOG FOR MORE INFORMATION.

ReplyDeleteThankyou for your consideration

Upcoming IPO