Weekly Trending Stocks India - Lakshmi Finance & Industrial Corporation Ltd

Lakshmi finance & Industrial corporation Ltd share price is Rs.103.50 ( the stock price was Rs. 135 when this post was created)

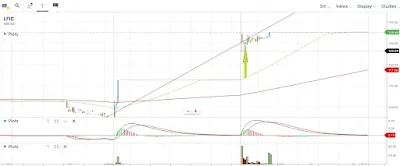

Weekly Chart

From the chart, the Lakshmi finance share price has almost increased up to 19.9 percent during the past week with a huge volume change. In the last trading session the stock price stood at Rs.135. The 50 SMA has overtaken 200 SMA with a vibrant uptrend. MACD also went to an over bought state and during the last trading session the stock price consolidated at a price of 135 as on Sept 5, 2022 and no change over that day.

Stock chart as on Nov 6, 2022

The stock price chart of Lakshmi finance is given above. The stock price has went down after the creation of the initial post and it has mentioned above. As on Nov 6, 2022 the chart formed a symmetric triangle pattern. The stock is getting to a breakout zone which can be either bullish or bearish. Save this stock into your portfolio. If you see the bullish breakout then place a long position at an entry level of Rs.127 with a stop loss of Rs.103. The target can be set at 168 level.

Disclaimer

The stock information giving in this section is only for information on trending stocks in Indian share market and purely not a stock recommendation. The motto is to give updates on random stocks in stock market this week that has well performed.

Company Overview

The company was formerly known as "The Andhra Bank Ltd." and is a public limited company. After the Andhra Bank was nationalised on April 15, 1980, the company's name was changed to Lakshmi Finance & Industrial Corporation Limited, and it has since engaged in financial activities (leasing, hire purchase, bill discounting, corporate finance, etc.) as well as manufacturing for a period of time (from 1988 to 2002). (Manufacturers of PET containers and injection moulded components).

Since 1982, the company has paid dividends. Bonus shares were given in 1992, 1996, and 2009. It was listed on the Hyderabad Stock Exchange until around 2006. Later, after the de-recognition of the Hyderabad Stock Exchange, the company continued its listing at the Madras Stock Exchange. Following that, SEBI requested a voluntary surrender of Madras Stock Exchange's recognition in accordance with the then-current regulations and left before the deadline of May 30, 2014. The Company has applied for the listing of the Company Shares at the National Stock Exchange of India (NSE) at the same time. The Company Shares were Listed on NSE with Effect from 15.04.2015 after Complying with NSE Listing Requirements.

Sectors Financed

- Active Pharamceutical Ingredients (Bulk Drugs).

- Engineering Works

- Manufacturing Units

- Trading Units

- Realty

- Construction

- IT / Software

- Infrastructure

- Medical & Health

Annual Report 2020-21 and company financials

INVESTMENTS: The total amount of investments as of March 31, 2021, excluding fixed deposits and government bonds, was Rs. 3,351.31 lakhs, up from Rs. 2,411.81 lakhs and Rs. 450 lakhs as of March 31, 2020.

- Equity Capital and Reserves - 4223.37 Lakhs ( FY 2020-21)

- Investments - 3351.31 Lakhs ( FY 2020-21)

- Net Profit/(Loss) (after tax) - 915.35 Lakhs ( FY 2020-21)

- Dividend (%) - 30%

- Earnings per share - Earnings per share

Company projections for governance include serving the interests of all stakeholders; upholding board and management responsibility; establishing long-term, successful stakeholder engagements; and promoting corporate ethics and values.

Company has a positive cash flow for the financial year 2020-21. The total investment made by LFIC during the FY21 was Rs. 380,130,520 and it includes investment in MFs, Equity instruments, Public deposit with NBFCs and Government bonds.

The major activities done by the company is investment itself and that is a positive factor as the investments always protect the capital and it can be well seen in the last annual report of the company. LFIC has made a tremendous growth over the year 2020-21.

Important Ratios

- Stock P/E 4,062

- Dividend Yield 2.22 %

- ROCE 14.1 %

- ROE 12.8 %

- Return on assets 12.1 %

I liked reading it

ReplyDeleteBrokerage Calculator