Personal Finance Management - Importance of share market investment

Almost everyone experienced a struggling in life during the pandemic period we faced. Somehow we passed the situation and however we managed it. This financial year everyone's personal finance is going to see specific changes as this difficult situation taught us all some lessons. The conventional investment ideas are degrading and the returns receiving from those streams are becoming inadequate for our needs. At this time there shows a rising tendency among people to invest in stock market rather than those conventional investment ideas. The change signals us that the expectation of returns from our hard earned money had changed.

Let us make a review over the returns of popular investment plans now available.A normal savings account deposit will give a returns of 4% annually. As per the studies, the inflation rate in India during the year 2022 is 5.67%. So , A savings account deposit will not fulfill your investment goals. Similarly , A PPF account gives 7.1% returns, FD gives 5.50% returns, SSA Scheme gives 7.6% returns annually. Is this returns sufficient to achieve your goals?

Now we may look at some other plans. A Debt mutual fund, it will give you a return of 10% and an equity mutual fund will give you a return of more than 15%. From these data we can see that we have to shift our investment to plans that provide minimum requirements as we expected. Now let us focus into stock market. Everyone will be heard about Tata groups. Over the past 5 years Tata Elxsi has given a CAGR ( Compounded annual growth rate) of 60% and Tata Tele given 90%. From these figures the potential of Indian stock market is clearly visible over long-term.

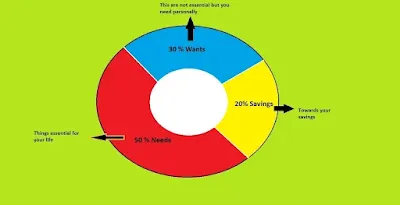

Converging to the topic now we know where we have to invest the money we earn with our own blood and sweat. Now let's discuss about the finance planing and management for this financial year. For that we have to re-examine our spending over these few months and create an estimate for the coming months. Now we can apply the common rule on that 50-30-20 rule. According to this rule 50 percent of our income will go for needs, 30 percent towards wants and 20 percent for savings.What all are the other factors under consideration when thinking about a solid financial back up in few years??

Let sort out the facts that we have to analyze for achieving those goals...

- Setting up your financial goals What is our financial goals? what we are planning to become in our next 10 year or what ? You must have a clear cut answers for these questions. We have to track our milestones throughout this journey and track the percentage to completion. The goals such as debt clearance, New house, Car, etc we have to track all these accomplishments and record your progress. This will help you to feel comfortable over your growth.

- An emergency fund Loss of employment, some of us may have faced this situation during the pandemic. Planning our emergencies may assist us to overcome these situations. The importance of keeping an emergency fund has due importance. This is because when you lose your job, the compulsary payments like your loan emi, child's education, health related expenses these things had not be get affected. So set a plan to create an emergency fund for securing your financial goals.

- Credit card management Credit cards are good if we know how to use it otherwise it will become the primary course of our financial break. Credit cards must be considered as our last choice of emergency. The usage of it over daily needs makes our debt rule over earnings. Always remember to set a limit for your credit card usage and ensure that the credit card pay off are made regularly.

- Insurances Insurance is a necessary factor for getting you and your family under a safe home. Properly assigned insurance will provide you best protection in life. I personally suggest a term insurance for this purpose because insurance is not a investment . We don't have to expect any return from that. It actually covers you and your family from unexpected fatalities. Be sure that you have one.

- Debt clearance We cannot avoid debt but we can control it. For almost everyone there will be atleast one EMI currently going on. In this Fiscal try to avoid adding your debt instead of try to clear off the existing ones. Also the act of consolidating your debt into a single loan even help you to avoid the burden of self exhaustiveness. check my article on Debt trap related to this context.

- Self Investment This pandemic situation was the best period for people they intended to develop themself. So many people who lost their job and was on work from home found time to study new skills and complete online courses. This will surely help with their career. Even myself engaged in study of stock market and made my investment strategies better. I attended a communication class which benefited my language skills also made a layout for my future business plans. The period that everyone suffered was actually a gift for me personally. I got enough time to prepare myself. The sad news is that I lost my job due to the pandemic. The company no longer needed entire employees for their running and somehow it was a gift for me. So find time to invest in yourself. It will give you best results.

Comments

Post a Comment