Fundamental Analysis Part 4 - fundamental analysis of stocks

In the previous post, the qualitative aspects of fundamental analysis were discussed. Qualitative analysis of a business involves the study of the quality of a business apart from its numeric aspects. Financial figures are a part of the quantitative features. In this article it is going to explain the company fundamentals, the quantitative aspects of the company. Some of the quantitative parts are simple, others are not. Some figures of quantitative aspects are listed below.

Profitability

Earnings

Operating efficiency

Dividend payouts

Tax paid

Cash flow

Debt and related party transactions

Investments

Financial ratios

And the list continues..

Now the basic factors that have to be discussed in qualitative and quantitative analysis have mentioned. It is now going deep into that factors.

As we said earlier, every year, the corporation publishes an annual report (AR), which is distributed to shareholders and other interested parties. The annual report is released by the conclusion of the financial year, and all the information it contains is current as of March 31st. The annual report is typically accessible as a PDF document on the company website or on other third-party websites like screener, money control, etc. Everything mentioned in the annual report (AR) is taken as official since it is published by the company. Any falsification of information in the annual report can therefore be used against the corporation.

Reading an entire annual report of a company will be the most boring part of fundamental analysis. But actually, there is no need to read the entire pages of an annual report. We can condense the entire pages by reading some selective portions. Here we are getting into that information.

For the study, I am taking the annual report of NCC Ltd for the financial year 2021–22. In general, the following portions are the important data we have to analyse while reading an annual report.

Business Information

Corporate Information

Chairman’s Letter

Board’s report

Shareholding Information

Report on Corporate Governance

Management discussion & Analysis

Financial statements

On this LINK you can download the annual report of NCC for the financial year 2021–22. Download and save it because you may need it in future content. The page number relating to every topic will be mentioned for your reference. Let’s get started on the study.

Business Information ( Page 18,19)

- What’s the company selling or what do they do?

- The geographic presence of the company

- The mile stones they achieved

- products or services that a company offers.

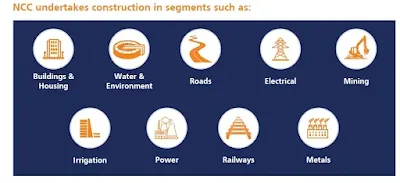

NCC Ltd is engaged in the infrastructure sector. It was established in the year 1978 and they undertake construction of buildings and housing, water and environment, roads, electrical, mining, irrigation, power, railways, metals, etc.

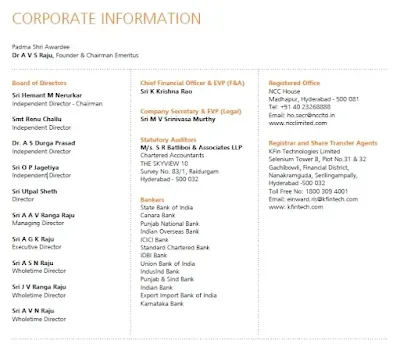

Corporate Information (Page 20)

In this section, we have to

look up the management personals of the corporation. Look on to the points given below. For understanding what corporate information is you have to briefly explain on these points.

- Who all is there in the managing position?

- Chief financial officer.

- There banks

- board of directors , etc.

The chairman of NCC Ltd is Sri Hemant M. Nerurkar. You can check his profile on the internet and understand how he runs the business. If the management is family controlled, it will be even better for management.

Hemant M. Nerurakar holds a BTech in Metallurgical Engineering and has held several prestigious positions within the Tata Group. (Since 1982, various positions with Tata Steel, including Chief Metallurgist, Senior Divisional Manager, Deputy General Manager, Steel & Primary Mills, General Manager, Marketing, Senior General Manager, Supply Chain, and Chief Operating Officer; 2002, Vice-President, Flat Products; 2007, Chief Operating Officer; from April 2009, Executive Director, India and South-East Asia; and since October 2009, Managing Director.) This data is taken from Google provided by the World Economic Forum. Like this, you can search for each and every single person and analyze the management capability to run the business.

Chief financial officer - Sri. K Krishna Rao.

Statutary Auditors - M/s. S R Batliboi & Associates LLP

Search

for this names on internet and research. You will understood it better.

Chairman’s

Message (Page 23,24)

The chairman’s message is the very important part of an annual report. Investors can learn how the person at the top of the organization is approaching his business in the Chairman's Message. This content typically covers a wide range of topics and provides insight into how the company is positioned. Throughout this part, I evaluate the management's realism. I am really interested in seeing if the company's management is grounded. I also check to see if they are open about disclosing specifics of the business's successes and failures. It should be realistic, forward-looking, and genuine. We should keep a close eye on this. Some companies will try to exaggerate things that aren't there. You will get a rough idea from the chairman's message whether the things mentioned in the annual report you are reading are real. I have read the chairman’s message of NCC Ltd. It is classy and the most realistic.

“Margins during the year were subdued because of higher commodity prices.” – (Sri Hemant M Nerurkar.)

The chairman is explaining why the margins are subdued this financial year. Despite this, the revenue generated and orders attained were far better than the previous financial year. The financial decisions (on interest rate and repo rates) made by the RBI have adversely affected the infrastructure sector. Even though the business-driven factors are explained in the chairman’s letter,

The content length is increasing too much. So the remaining parts will be uploaded later. Read the full content. I am giving you a word that when you complete this content, you will be able to read an annual report easily by yourself. In this content, business information, corporate information, and the chairman’s letter are all explained.

For reading the first content on Fundamental analysis Click here

Read : Weekly Trending Stocks - Week 2 - Lakshmi Finance & Industrial Corporation Ltd

Read : Food safety requirements when providing Food and Drink for individuals

Earning money online is not hard as you think. Earn your first income online as a freelance writer . Click the LINK for registration.

TIPS

Comments

Post a Comment