Nestle India Ltd Company in India review and fundamental analysis – Weekly trending stocks – Down 52 week high

Nestle

India share price is Rs. 20282 and as on 05.11.2022 is Rs.20422 (blog post updated)

Nestle India Limited is a subsidiary company in India of Swiss multinational corporation Nestle. The business is

involved in the food industry. The business maintains a solid market position

in the majority of the product categories in which it operates. Nestle India Ltd

sells a variety of products under the Maggi name, a pioneer in the culinary

industry. In most of its product categories, including beverages, prepared

foods and cooking utensils, chocolate and confectionery, milk products, and

nutrition, the company is one of the top two suppliers in India.

Revenue distribution

As of September 2020, Nestle stock revenue is made up of 47% milk and nutrition products (dairy goods and weaning foods), 10% beverages (instant coffee, iced tea, and other beverage vending mixes), 30% prepared foods and cooking aids (the Maggi line), and 13% chocolates and confectionery (including Kit Kat and Munch).

| trending stocks |

The stock price is down

from its 52-week high. The company has a solid history of return on equity

(ROE): The company has consistently paid out a healthy 117% dividend and

debt-to-equity is less than one.

Major personals

- Mr. Suresh Narayanan, Chairman & Managing Director

The corporation was experiencing its greatest crisis ever when Mr. Narayanan was appointed in 2015. Its flagship brand, Maggi, had issues with the Indian food authorities and was taken off the shelves in various areas. Aside from monetary losses, Maggi was suddenly faced with a significant loss of customer trust and severe harm to its brand equity.

He immediately started reviving the company's connections with numerous shareholders, including consumers and the government, while also rebuilding confidence among his workers. He is a major proponent of focusing on "People, Purpose, and Partnership." Nestle India enjoyed nine consecutive quarters of double-digit value growth at the end of 2019.

-

Mr. Suresh Narayanan was named India's Best CEO, FMCG by Business Today.

-

The Chairman and Managing Director of Nestle India, Mr. Suresh Narayanan, received the EY Entrepreneur of the Year 2020 Entrepreneurial CEO Award.

-

One of the Top 101 Male Gender Equality Champions in the World is Mr. Suresh Narayanan.

CFO – Mr. David S McDaniel

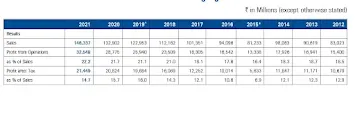

Achievements over the last 15 years

- Reduced Direct GHG emissions by 57%

- Reduced energy usage by 43%

- Reduced water usage by 52%

- Reduced waste water generation by 67%

- Nestle has started its ninth factory at Sanad in Gujarat. Women make up 70% of the factory's workforce, and this is their most technologically advanced factory.

10 year financial highlights

As of March 2022, there have been no material changes or business changes that have affected the company. This indicates the responsibility of the management to its investors.

Dividends

For 2021, the Board of Directors has recommended a final dividend of 65 cents per equity share, or $6,267.0 million, for approval by the shareholders at the company's 63rd Annual General Meeting ("63rd AGM").

The interim dividends of '25' and '110' per equity share, paid on May 19th and November 16th of 2021, respectively, are included in the total dividend for the year 2021, which totals '200/-per equity share.

A dividend of Rs 120 per share is forthcoming from Nestle India Ltd. and is due on October 31, 2022.

Learn how dividends protects the investor

Portfolio wise development

The increased sales of MAGGI noodles and MAGGI-ae-Magic boosted the profitability of the prepared foods and cooking aids portfolio.

MAGGI and NESCAFÉ India have been named the most popular brands in India by Marksmen Daily and Zee Business for 2021.

MAGGI was included in Kantar BrandZ India's Most Purposeful FMCG Brand List.

E-Commerce contributed

towards driving the performance of milk products and the nutrition category.

MILKMAID has increased its engagement through its digital platform 'milkmaid.in’.

Management analysis

After shrinking 3.4% in 2020, the global economy accelerated to an expected 5.5% growth in 2021. Due to ongoing supply chain bottlenecks and growing freight costs globally, which have an impact on global production and commerce and raise the cost of basic products, worldwide inflation surged to 5.2% in 2021. 2021 saw a 22% increase in the price of food. In December 2021, India's Consumer Price Index showed a 5.6% YoY increase.

The food processing sector in India has enormous growth potential. Neslte India anticipates that the demand for processed foods will continue to be driven by rural areas and Tier 2 and Tier 3 cities. According to the management analysis, food firms may anticipate exceptional growth if they continue to use their in-depth understanding of dietary preferences, nutrition, quality, and safety to innovate, renovate, and adapt to this new normal.

Financial statement 2021-22

- The non-current asset category, including property and plants, has increased to 54,711.7 lakhs from 37,146.5 lakhs in the financial year 2021.

- Total income in March 2022 was 148,295.2 lakhs, a 9% increase.

- PAT is Rs. 21,448.6 lakhs.

- The net cash from operating activities fell by 8%.

- Property, plant, and insurance investments have increased by 314 percent.

- As the company did more investment activities, the cash on hand at the end of the year was only 7734 lakhs as compared to the 24777 lakhs of the year 2021.

Drawbacks of the company

- 84 times the book value of the stock is being traded.

- Over the last five years, the company has generated a dismal revenue increase of 9.98%.

Technical Analysis

- Score for Day Trendline Momentum: 64.2

- The stock is technically moderately strong with a core of 64.15. Stocks with a score of 60 to 70 are regarded as moderately strong technically.

- The MACD is a bullish indicator when it is above both its centre and signal line.

- The RSI is 63.2; RSI values below 30 are regarded as oversold, and values above 70 as overbought. – NEGATIVE

Related topics : Fundamental Analysis Part 4 - Quantitative aspects of fundamental analysis

Related topics : Weekly Trending Stocks - Week 2 - Lakshmi Finance Industrial Corporation Ltd

Related topics :Indian Railway Catering Tourism Corporation Ltd - Trending of the week

Visit my YouTube channel Stock Market Trends and learn more on technical analysis

Earning money online is not hard as you think. Earn your first income online as a freelance writer . Click the LINK for registration.

Comments

Post a Comment