Technical analysis - Best Bollinger bands trading strategies

Technical analysis and Technical indicators

Technical analysis is the procedure of analyzing the trends of a stock by interpreting the factors like volume and price movement. It believes that the past trading history of a stock may repeat in the future under certain circumstances. A technical indicator is a tool derived from the past price, volume and investor activities of a stock and used to determine the stock market trends and trading strategy for future applications.

Bollinger Bands technical Indicator

Bollinger bands technical indicator is developed by John Bollinger, an American financial analyst. Bollinger bands are seen in a stock's chart as two bands (upper and lower) plotted in accordance with the simple moving average of the stock's price. The upper and lower bands are defined at a certain standard deviation level of the simple moving average.

The default value of the period of simple moving average is 20 and 2 for standard deviations. Bollinger bands assist in identifying relative price levels (highs and lows).

How does the Bollinger bands indicator works?

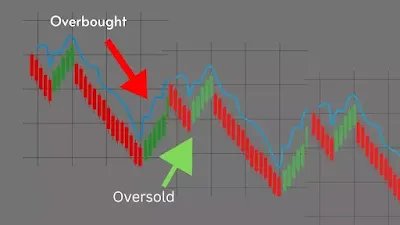

When the stock's price is above the upper band level of Bollinger bands, it indicates that the stock is under a overbought condition. Similarly, when the stock's price is below the lower band level, it indicates an oversold condition of the stock.

When the bands come closer together, the condition is called Squeeze. It indicates a low volatility condition and is considered that the chances of a future volatility hike and some possible trading opportunities. Similarly, when the bands extend beyond the range, It indicates that the volatility increases and the ongoing trend is diminishing.

Calculation

Bollinger upper band = SMA(20 periods) + 2 * SD over last 2 periods.

Bollinger lower band = SMA (20 periods) - 2 * SD over last 2 periods.

SMA - Simple moving average

SD - Standard deviation

Bollinger bands trading strategies

In this article, five trading strategies of bollinger bands are explained. Simple trading strategy, Bollinger bands-RSI trading strategy,Bollinger bands double bottom strategy, Bollinger bands - SMA strategy and Bollinger Bands- MACD trading strategy.

Simple trading strategy

As we said earlier, Bollinger bands indicator is used to identify the overbought and oversold conditions of a stock. Trades are executed using this overbought and oversold concept.

If the price of the stock is higher than the upper bollinger band. Then it indicates an overbought condition of the stock. Hence we can exit a long position that has already entered because the price may fall due to the overbought condition. Similarly, when the price of the stock is below the Bollinger lower band, it indicates an oversold condition of the stock. Hence, a long position can be entered as the stock price may rise after an oversold state. This is a simple trading strategy of Bollinger bands.

Bollinger bands - Relative strength Index (RSI) Trading Strategy

In the Bollinger bands- RSI trading strategy, RSI is used to confirm the trend reversal and execute a trade. The RSI is a technical indicator that compares the timeframe over a period of time that a stock closes up vs closing down. Following that, these values are displayed on a scale from 0 to 100, with overbought condition is when the RSI gives a value above 70 and oversold when the value is below 30.

As we have seen earlier in the simple trading strategy of Bollinger bands, if stock price is seen above the upper band of Bollinger bands and the RSI indicator is showing lower highs. Then it indicates a Bearish divergence and the stock price may fall. Hence, a short position can be taken.

Similarly, if the stock price is below the lower Bollinger bands and RSI indicator is showing higher lows, it shows a bullish divergence. Hence, a long position can be taken.

Here, RSI is used for confirming the trend reversal. Bollinger bands- RSI trading strategy and Simple trading strategy is detailed in the video shown below.

Bollinger Bands Double Bottom Strategy

Double bottom is a common Bollinger band strategy with a bullish pattern. For confirmation of a double bottom pattern, the stock price must be creating a double bottom in which the second bottom is formed lower than the first bottom. Also, the first bottom should be below the lower Bollinger band level and second bottom within the band. The formation of the first bottom must be in high volume. This formation is also called as an Automatic rally.

Formation of a double bottom indicates that the sell pressure over the stock is diminishing and buy pressure is increasing. A long position taken after the formation of a double bottom may give a huge rally. The process of formation of a double bottom is termed as base-building process.

Related articles : Stock market technical analysis - ASI, Alligator and Anchored VWAP - Trading indicators explained

Bollinger bands - Moving average strategy

In Bollinger bands - Moving average strategy, a 50 SMA (simple moving average) is plotted along with the Bollinger bands.Technical analysts generally employ moving averages as indicators to help smooth out short-term "noise" and determine long-term price movement.

For entering a buy position using Bollinger bands - Moving average combo, certain criteria have to be met. They are

1- 50 SMA plot line must be in a uptrend,ie the slope of moving average has to be inclined upwards.

2- 50 SMA line has to be lying close to the lower Bollinger band.

3- There has to be a buy candle near to SMA and the lower Bollinger band coinciding area.

If these three criteria are met, a long position can be taken for a profitable trade. This trading strategy has been explained in detail in the video given below.

Bollinger Bands - MACD Trading Strategy

Here, Bollinger bands and MACD indicators both use simultaneously for confirming a trade signal. MACD indicator has two lines. One is the MACD line and the other is Signal line. A stock is said to be bullish if the MACD line moves upward crossing signal line and bearish if MACD line moves downward crossing signal line.

While using this strategy, we look upon the two indicators to get a trade signal. If Bollinger bands give a buy signal (All are explained above on BB signals) that is an oversold condition and MACD is also giving a buy signal that is MACD line has overtaken signal line upwards, then we take a confirmation for a long position. Similarly, If Bollinger bands are given a sell signal and MACD has also given a sell signal, we can take a short position. The Bollinger band- MACD trading strategy is explained in the video given below.

Bollinger band is an effective tool for doing technical analysis. By using multiple indicators together, a trade can be executed with atmost accuracy. The five trading strategies with Bollinger bands explained in this article are more common and successfully using by many traders. This article covered almost all strategies of the Bollinger band indicator. Using these strategies, we can perform a trade more profitable. Each indicator is specific for specific trading opportunities. Practice more and master it with experience.

Related articles :Technical indicators that helps in technical stock analysis over long-term and short-term

Amazon ads : 13 Swing Trading Strategies| Pankaj Ladha | Anant Ladha | Invest Aaj For Kal

Career Tips

Interested in freelance writing ?

Earn money as a freelance writer ... Best platform for freelance writers .. Click here for registration

Comments

Post a Comment